Step Into the Spotlight with Project Loop

Step into a place made for sketch-stained hands, big ideas, and brave experiments. At Project Loop, working artists guide you from first lines to finished pieces, helping you build real skills and a style that feels like you. Don’t wait for “someday” — your next canvas, screen, or sketchbook is ready right now.

Theatre Art Focus

Theatre & Performance Training for Every Dreamer

We’ve built Project Loop as a creative playground where beginners, emerging artists, and working performers all feel at home. Our classes are crafted to build confidence, sharpen technique, and spark bold artistic choices. Whether you’re chasing auditions, building a portfolio, or simply curious about theatre, there’s a path here with your name on it.

Acting for Stage

Learn to own the room. From script analysis and character work to improvisation and ensemble play, you’ll discover how to tell stories that truly land with an audience.

Musical Theatre & Voice

Dance for Actors

Loosen up, tap into your body, and expand your range. Through contemporary, physical theatre, and expressive movement, you’ll learn to speak volumes—long before you say a word.

Stagecraft & Production

For the creatives behind the curtain. Explore set design, lighting, sound, costumes, and stage management so you can build the worlds that performers bring to life.

Wandering Souls

Discover Your Next Role with Project Loop

Runegamble: Elevate Your Gaming Experience with Online Gambling

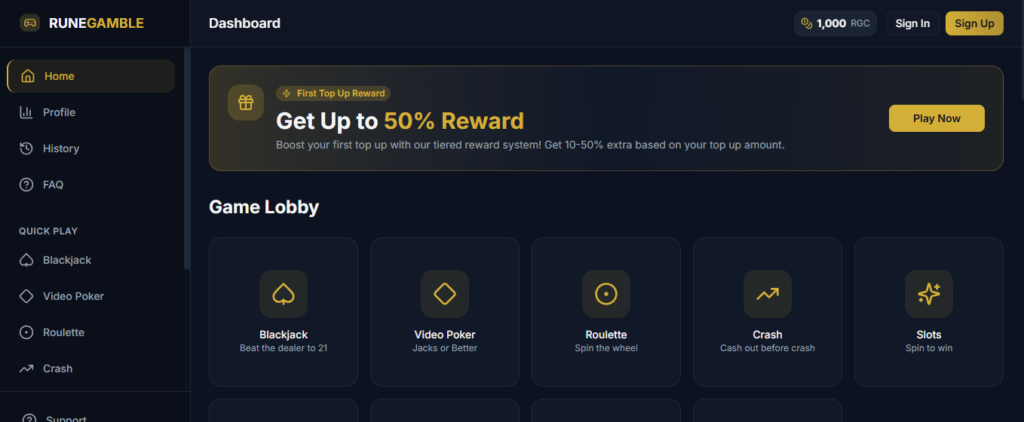

Welcome to Runegamble, where your online gambling adventures reach new heights! As a premier destination in the digital gaming world, Runegamble is dedicated to providing an exhilarating gaming experience that combines fun with security. Whether you’re a fan of thrilling slots or strategic table games, our platform offers an array of options to satisfy every player. Recognized as a trusted name in the online gambling community, Runegamble ensures that your entertainment is not only enjoyable but also safe. With generous bonuses and a commitment to provide the best in gaming, you are just steps away from elevating your gaming journey.

Key Takeaways

- Runegamble offers a thrilling gaming experience for all players.

- The platform is recognized as a trusted name in online gambling.

- Enjoy a wide variety of games, from slots to table games.

- Runegamble is committed to ensuring a safe gaming environment.

- Players can take advantage of enticing bonuses.

Introduction to Runegamble

Runegamble stands out in the competitive landscape of online casinos, offering a unique gaming platform that delights players worldwide. Founded with a vision to transform online gambling, Runegamble emphasizes user experience by providing an intuitive interface and seamless navigation. Players can easily explore various games and features designed to keep them engaged.

The gaming platform takes pride in its commitment to fair play and security, ensuring a safe environment for all users. Runegamble combines this with an extensive selection of games catering to diverse tastes, whether you’re a novice eager to learn or an experienced gambler seeking thrilling options. As technology continues to advance, Runegamble strives to stay ahead by continuously enhancing its offerings, making it a reliable choice for online gaming enthusiasts.

Why Choose Online Gambling?

The surge in popularity of online gambling stems from its numerous benefits that resonate with a wide range of players. One of the key advantages is the convenience it offers. Players can access their favorite games from the comfort of their homes or while on the move. This flexibility allows for a personalized gaming experience that aligns with individual schedules and preferences.

Additionally, online platforms provide 24/7 access to a vast selection of games. Unlike traditional casinos, which have operating hours, players can enjoy gaming anytime. This freedom translates to an unmatched variety of options, from classic table games to modern video slots.

Beyond accessibility, online gambling often features better odds compared to physical casinos. Many sites boast lower house edges and attractive bonuses that enhance the overall gaming experience. For those exploring the benefits of online gambling, these financial incentives make it an appealing choice, allowing players to stretch their budgets.

In essence, the combination of convenience, flexibility, and better financial prospects positions online gambling as a favored option for enthusiasts. As the digital gaming landscape continues to evolve, many are leaning toward these virtual platforms to fulfill their gaming desires.

Explore the Unique Features of Runegamble

Runegamble stands out with its array of unique features that provide players with an exceptional gaming experience. The platform prioritizes quality, ensuring users have access to thrilling options that replicate the excitement of traditional casinos. A significant part of this immersive gaming experience comes from the live dealer games that connect players directly with real dealers, enhancing the overall enjoyment.

Live Dealer Games: A Real Casino Experience

The live dealer games at Runegamble offer an authentic casino atmosphere right from the comfort of home. Players can interact with real dealers through high-quality streaming, creating opportunities for social interactions. This unique feature doesn’t just focus on winning; it emphasizes the entire gaming journey, making every session feel like a visit to a physical casino.

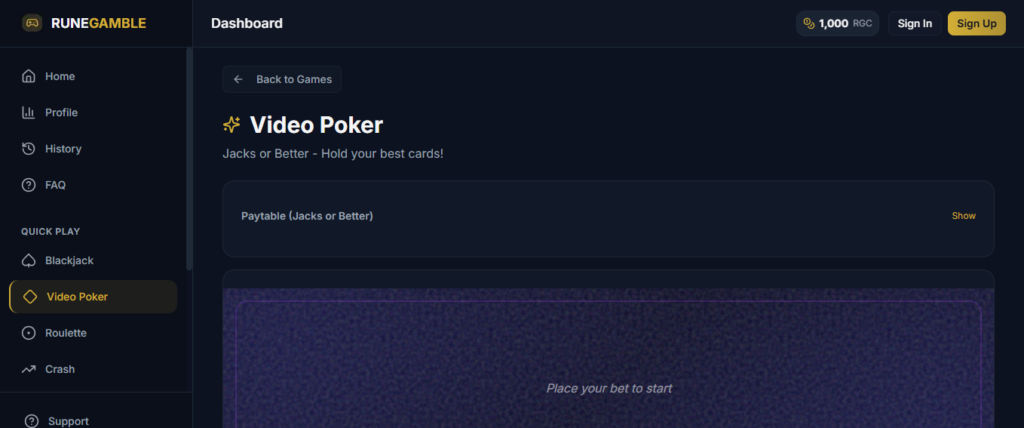

Variety of Games: From Slots to Poker

In addition to live dealer options, Runegamble presents an extensive variety of gaming options, featuring everything from classic slots to high-stakes poker tables. This diversity caters to different player preferences and skill levels, guaranteeing that everyone can find something appealing. With partnerships with leading game developers, the platform boasts visually stunning games that engage players and keep them coming back for more.

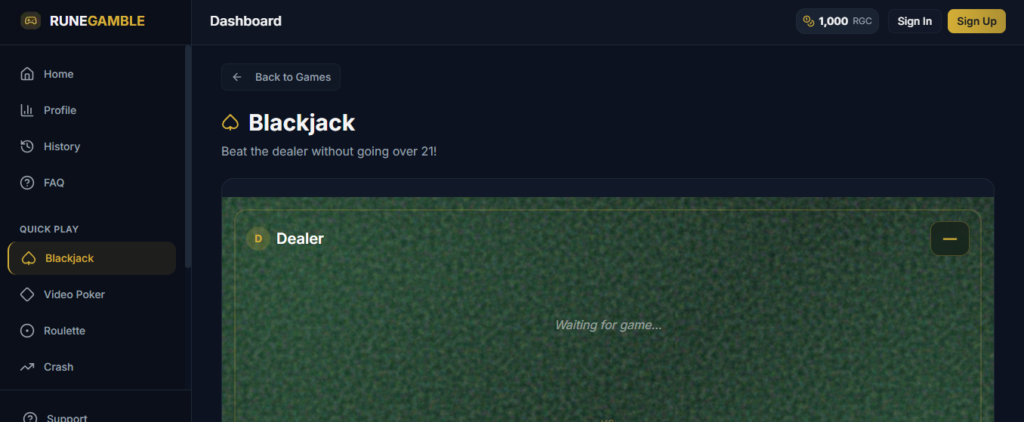

How to Get Started on Runegamble

Getting started with Runegamble is a seamless experience designed to attract both novice and seasoned online gambling enthusiasts. The platform prioritizes user account creation with a simple and efficient sign up process. Players will find that account registration takes only a few moments, enabling them to dive into the ultimate gaming experience.

Creating Your Account

The first step to enjoying all that Runegamble offers involves creating your user account. The registration form requests basic personal information such as your name, email address, and preferred password. After filling in these details, you’ll need to verify your identity to ensure a safe gaming environment. This verification step also meets legal requirements, allowing smooth and secure transactions for online gambling.

Making Your First Deposit

Once your account registration is complete, it’s time to fund your account. Various deposit methods are available, such as credit cards, e-wallets, and bank transfers. Selecting the payment method that suits you best is essential for Hassle-free online payments. Your first deposit will typically have a minimum requirement, so be sure to check out this information. Once you complete your deposit, you can start enjoying the exciting games Runegamble has to offer!

Website Link: Accessing Runegamble

Accessing Runegamble is easy with the right website link. Start by entering the URL into your web browser to reach the main site. Once there, you’ll find a user-friendly interface designed for seamless navigation. If you prefer quick access, consider bookmarking the page. This will let you return without searching every time.

Before you dive into gaming, ensure your device meets necessary technical requirements. A stable internet connection enhances your gaming experience, allowing you to engage with various features without interruptions. Following these steps will enable you to access Runegamble smoothly and enjoy all that it has to offer.

Bonuses and Promotions at Runegamble

At Runegamble, the excitement begins with a variety of bonuses and promotions designed to enhance the gaming experience for both new and loyal players. These player incentives serve as a thrilling way to explore the vast options available on the platform.

Welcome Bonus for New Players

New players are greeted with a generous welcome bonus upon signing up, which often includes matched deposit bonuses or exciting free spins. These sign-up incentives play a crucial role in attracting new players, inviting them to dive into the diverse selection of games. Players can maximize their fun and make the most of their initial experience with these exclusive offers.

Regular Promotions for Loyal Gamers

Runegamble values its existing players and provides regular promotions to keep the excitement alive. Features such as reload bonuses, cashback options, and a comprehensive loyalty program ensure that players feel appreciated and engaged. These ongoing promotions not only reward commitment but also assist players in learning about terms and conditions that can help maximize their benefits.

Responsible Gambling at Runegamble

Runegamble is dedicated to promoting responsible gambling, prioritizing the safety and well-being of its players. The platform provides a variety of tools designed to support safe gaming practices, empowering players to manage their gaming habits effectively.

Among the resources available, players can set deposit limits to cap their spending. This feature encourages mindful gaming by allowing individuals to establish their own financial boundaries. Furthermore, self-exclusion options enable players to take a break when needed, reinforcing the importance of player protection.

Runegamble also offers access to resources for addiction support. These include links to organizations that specialize in helping individuals with gambling-related issues. By fostering a community that values responsible gambling, Runegamble actively works to create a safer environment for all players.

The commitment to responsible gambling not only enhances the gaming experience but also ensures that players can enjoy their time without the adverse effects of gambling addiction. By adopting these measures, Runegamble demonstrates its unwavering dedication to safe gaming practices.

| Responsible Gambling Tools | Description |

|---|---|

| Deposit Limits | Allows players to set a maximum limit on their deposits to promote responsible spending. |

| Self-Exclusion Options | Provides an option to temporarily or permanently suspend account access for personal reflection. |

| Access to Support Resources | Offers links to organizations specializing in gambling addiction support and education. |

Customer Support and Resources

Runegamble prioritizes player satisfaction by offering comprehensive customer support options. Players can reach out via multiple channels, including live chat and email, ensuring prompt assistance for any inquiries or issues that may arise. The live chat feature provides instant communication, making it easy to solve problems on the spot.

In addition to direct support, Runegamble provides valuable player resources designed to enhance the gaming experience. Detailed guides cover essential gaming rules and strategies, empowering users to make informed choices during their play. These resources serve not only as a means of assistance but also as tools for improving player engagement and enjoyment.

Conclusion

As we reach the end of this Runegamble review, it’s clear that this platform stands out in the world of online gambling. By offering a diverse array of games—from captivating slots to strategic poker—and an engaging live dealer experience, Runegamble enhances your gaming experience like no other. Whether you’re a seasoned player or new to the scene, there’s something for everyone.

Moreover, the generous bonuses and promotions provide excellent incentives to both new and returning players. With the commitment to responsible gambling, Runegamble ensures that fun remains at the forefront while maintaining a safe gaming environment. In this gaming experience summary, it’s evident that choosing Runegamble means choosing excitement and quality.

So why wait? By simply clicking the website link, you can dive into your online gambling adventure today. Embrace the thrill of gaming and discover what makes Runegamble a premier choice for players across the United States.

FAQ

What types of games can I find on Runegamble?

Runegamble offers a wide variety of games including classic slot machines, video slots, table games like blackjack and roulette, and exciting poker options. Every player can find something that suits their preferences!

How do I create an account on Runegamble?

Creating an account is easy! Simply fill out the registration form with your basic personal information, verify your identity, and you’re ready to enjoy the gaming experience on Runegamble.

What payment methods are accepted for deposits?

Runegamble supports multiple deposit methods such as credit cards, e-wallets like PayPal and Skrill, and bank transfers. Choose the option that works best for you to fund your account easily and securely.

Are there bonuses for new players at Runegamble?

Yes, new players can take advantage of the welcome bonus, which often includes matched deposit bonuses or free spins. This is a perfect way to kickstart your gaming adventure!

What promotions does Runegamble offer for returning players?

Runegamble values its players with various ongoing promotions such as reload bonuses, cashback offers, and a loyalty program designed to reward your commitment. Keep an eye on the website for the latest offers!

How can I access Runegamble?

You can easily access Runegamble through its dedicated website link. Bookmark the site for quick access, and ensure that your device meets the necessary technical requirements to enjoy a seamless gaming experience.

What is Runegamble’s policy on responsible gambling?

Runegamble is committed to promoting responsible gambling. They provide tools to help manage your gaming habits, including deposit limits and self-exclusion options, plus access to resources for addiction support.

How can I contact customer support at Runegamble?

If you have questions or need assistance, Runegamble offers robust customer support via live chat, email, and an extensive FAQ section. Help is always available to enhance your gaming experience!

PropertyInvestment.net: Your Guide to Successful Property Investing

Welcome to PropertyInvestment.net, your comprehensive guide to navigating the world of property investment and real estate investing. Our platform is designed to provide you with the resources and tools necessary to achieve success in your investment journey.

With a friendly and approachable tone, we’ll explore how PropertyInvestment.net can be your partner in building wealth through real estate. Whether you’re a seasoned investor or just starting out, our goal is to empower you with the knowledge and insights needed to make informed decisions.

Key Takeaways

- Discover the comprehensive resources available on PropertyInvestment.net for property investors.

- Learn how to navigate the world of real estate investing with confidence.

- Understand the tools and features that make PropertyInvestment.net a valuable partner in your investment journey.

- Explore strategies for building wealth through successful property investment.

- Get started on your path to successful real estate investing with PropertyInvestment.net.

Understanding PropertyInvestment.net and Its Resources

PropertyInvestment.net stands out as a premier online resource, providing investors with the insights and data needed to make informed decisions. The platform is designed to cater to both novice and experienced investors, offering a comprehensive suite of tools and educational materials.

What PropertyInvestment.net Offers to Investors

PropertyInvestment.net is equipped with a variety of features that make it an indispensable tool for property investors. These include:

- Market Analysis: Detailed reports on current market trends and forecasts.

- Investment Strategies: Expert advice on various investment approaches.

- Property Listings: A database of properties available for investment.

How to Navigate the Platform Effectively

Navigating PropertyInvestment.net is straightforward, thanks to its user-friendly interface. Here’s how to make the most of it:

- Use the search function to find specific properties or market data.

- Explore the various sections, including Tools and Calculators and Educational Resources.

Tools and Calculators

The platform offers a range of tools and calculators that help investors assess the viability of potential investments. These include:

- Mortgage calculators.

- Return on investment (ROI) calculators.

PropertyInvestment.net also provides a wealth of educational resources, including articles, webinars, and guides on property investment strategies and market analysis.

By leveraging these resources, investors can enhance their knowledge and make more informed investment decisions.

The Fundamentals of Property Investment

Property investment has long been a cornerstone of wealth creation for many investors. Understanding its fundamentals is crucial for making informed decisions.

Why Real Estate Remains a Solid Investment Choice

Real estate investing offers tangible assets that can provide a sense of security and stability. Unlike stocks or bonds, real estate is a physical asset that can be leveraged in various ways.

Historical data shows that real estate values tend to appreciate over time, making it a potentially lucrative long-term investment. Additionally, rental income can provide a steady stream of cash flow.

Key Metrics Every Property Investor Should Understand

To evaluate investment opportunities effectively, investors need to understand key metrics. Two critical metrics are cash flow analysis and cap rate and ROI calculations.

Cash Flow Analysis

Cash flow analysis involves calculating the income generated by a property after deducting expenses. A positive cash flow indicates a profitable investment.

- Gross income

- Operating expenses

- Net operating income (NOI)

Cap Rate and ROI Calculations

The capitalization rate (cap rate) is the ratio of NOI to the property’s purchase price. It helps investors understand the potential return on investment.

| Metric | Description | Importance |

|---|---|---|

| Cap Rate | NOI/Purchase Price | Helps compare investment opportunities |

| ROI | Return on Investment | Measures overall investment performance |

Understanding these metrics is essential for making informed investment decisions and maximizing returns.

Identifying Profitable Investment Opportunities

To succeed in property investing, it’s crucial to identify profitable opportunities through thorough market analysis. This involves understanding the intricacies of the property market and being able to pinpoint areas that are likely to yield high returns.

Market Research Techniques

Effective market research is the backbone of successful property investment. It encompasses various techniques, including demographic analysis and understanding economic indicators.

Demographic Analysis

Demographic analysis involves studying the population characteristics of a given area, such as age, income levels, and occupation. This information helps investors understand the demand for different types of properties.

Economic Indicators

Economic indicators, such as GDP growth, employment rates, and interest rates, provide insights into the overall health of the economy and its potential impact on the property market.

Recognizing Emerging Property Hotspots

Identifying emerging hotspots is crucial for investors looking to maximize their returns. This involves analyzing growth patterns and understanding what drives them.

Growth Patterns to Watch For

Growth patterns can be influenced by various factors, including new infrastructure projects, changes in zoning laws, and shifts in population demographics. Investors should keep a close eye on these developments to spot emerging trends.

By mastering market research techniques and staying informed about emerging hotspots, property investors can make more informed decisions and increase their chances of success.

Property Investment Strategies for Different Goals

Different investment goals require distinct property investment strategies, each with its own set of advantages and considerations. Whether you’re aiming for long-term wealth, quick returns, or passive income, understanding the right strategy for your objectives is crucial.

Buy-and-Hold for Long-Term Wealth

The buy-and-hold strategy involves purchasing properties to hold onto for an extended period, typically benefiting from appreciation in value and rental income. This approach is ideal for investors seeking long-term wealth.

Fix-and-Flip for Quick Returns

Fix-and-flip involves buying properties at a low price, renovating them, and selling for a profit. It’s a strategy that requires a keen eye for undervalued properties and renovation expertise, offering quick returns for those who execute it well.

Rental Properties for Passive Income

Rental properties can provide a steady stream of passive income. Within this category, investors can choose between single-family rentals and multi-family properties.

Single-Family Rentals

Single-family rentals are often less complex to manage and can attract long-term tenants. They are a good starting point for new investors.

Multi-Family Properties

Multi-family properties, on the other hand, offer economies of scale and potentially higher returns, though they require more management effort.

Real Estate Investment Trusts (REITs)

For those looking to diversify their investment portfolio without directly managing properties, REITs offer a viable option. REITs allow individuals to invest in real estate without the need to physically own or manage properties.

| Investment Strategy | Primary Goal | Level of Management |

|---|---|---|

| Buy-and-Hold | Long-term Wealth | Moderate |

| Fix-and-Flip | Quick Returns | High |

| Rental Properties | Passive Income | Moderate to High |

| REITs | Diversified Portfolio | Low |

As illustrated in the table, each investment strategy has its unique characteristics and requirements. By understanding these differences, investors can make informed decisions that align with their financial goals.

“The key to successful property investment lies in choosing the right strategy that aligns with your financial objectives and risk tolerance.”

Financing Your Property Investments

Understanding the different financing options available is key to making informed property investment decisions. Property investors can choose from a variety of financing methods, each tailored to their specific needs and investment goals.

Traditional Mortgage Options

Traditional mortgage options remain a popular choice among property investors. These mortgages are offered by banks and other financial institutions, providing a straightforward way to finance property purchases. Fixed-rate mortgages offer predictable monthly payments, while adjustable-rate mortgages can provide flexibility with potentially lower initial interest rates.

Creative Financing Alternatives

Beyond traditional mortgages, investors can explore creative financing alternatives. These options can be particularly useful for investors who may not qualify for conventional loans or who are looking for more flexible terms.

Seller Financing

Seller financing is an arrangement where the seller of a property finances the purchase for the buyer. This can be beneficial for both parties, as it allows the seller to receive a steady income and the buyer to acquire the property without needing a traditional loan.

Hard Money Loans

Hard money loans are short-term, high-interest loans used to finance property investments. They are typically provided by private lenders and are secured by the property itself. While they come with higher risks, they can be a viable option for investors looking to renovate and flip properties quickly.

Leveraging Existing Assets

Investors can also leverage their existing assets to finance new property investments. One common method is using a home equity line of credit (HELOC).

Home Equity Lines of Credit

A HELOC allows homeowners to borrow against the equity in their existing properties. This can provide a significant source of funds for investment purposes, often at a lower interest rate than other forms of financing.

Risk Management in Property Investment

Understanding and mitigating risks is essential for property investors to thrive. Property investment can be lucrative, but it comes with its share of risks. Effective risk management strategies are crucial to navigate these challenges successfully.

Common Pitfalls to Avoid

Property investors often face several common pitfalls, including market volatility, unforeseen property damage, and tenant-related issues. Being aware of these potential risks allows investors to take proactive measures.

- Conduct thorough market research to understand trends and potential fluctuations.

- Regularly inspect properties to identify and address maintenance issues early.

- Implement robust tenant screening processes to minimize the risk of problematic tenants.

Creating Contingency Plans

A well-crafted contingency plan can be a lifesaver during unexpected events. Investors should prepare for various scenarios, including natural disasters, economic downturns, and legal issues.

- Develop a financial buffer to cover unexpected expenses.

- Identify potential risks and create strategies to mitigate them.

- Regularly review and update contingency plans to reflect changing circumstances.

Insurance Considerations

Insurance plays a critical role in risk management for property investors. It’s essential to understand the different types of insurance available and their benefits.

Property Insurance

Property insurance protects against damage to the property itself, covering risks such as fire, theft, and natural disasters. It’s a fundamental component of a comprehensive risk management strategy.

Liability Protection

Liability protection is equally important, as it shields investors from legal claims related to injuries or damages occurring on the property. This type of insurance can help safeguard an investor’s assets.

By understanding common pitfalls, creating contingency plans, and securing appropriate insurance coverage, property investors can effectively manage risks and protect their investments.

Legal Aspects of Property Investment

Property investment involves more than just financial decisions; it requires a deep understanding of legal aspects. Being aware of the legal landscape is crucial for protecting your investments and ensuring compliance with all relevant laws and regulations.

Understanding Contracts and Agreements

When investing in property, it’s essential to comprehend the contracts and agreements you’re entering into. Carefully reviewing all terms and conditions can help you avoid potential pitfalls. It’s also advisable to seek legal counsel to ensure that your interests are protected.

Navigating Zoning and Regulations

Zoning laws and regulations can significantly impact your property investment. Understanding these regulations can help you make informed decisions and avoid costly mistakes. Local zoning laws dictate how a property can be used, so it’s crucial to familiarize yourself with these laws before making a purchase.

Entity Structures for Property Ownership

Choosing the right entity structure for your property ownership is vital for tax and liability considerations. Common structures include Limited Liability Companies (LLCs) and corporations.

LLCs vs. Corporations

LLCs offer personal liability protection and tax benefits, making them a popular choice among property investors. Corporations, on the other hand, provide a more traditional structure but may have different tax implications. It’s essential to consult with a legal or financial advisor to determine which structure best suits your investment goals.

Tax Strategies for Property Investors

To optimize their investment returns, property investors must stay informed about the latest tax strategies and regulations. Effective tax planning can significantly impact the profitability of property investments, making it essential to understand the available tax benefits and how to leverage them.

Maximizing Deductions

One of the key tax strategies for property investors is maximizing deductions. This includes deducting mortgage interest, property taxes, operating expenses, and repairs. By keeping accurate records of these expenses, investors can reduce their taxable income and lower their tax liability. It’s also important to consult with a tax professional to ensure all eligible deductions are claimed.

Understanding Depreciation Benefits

Depreciation is another significant tax benefit for property investors. The IRS allows investors to depreciate the value of their properties over time, typically 27.5 years for residential properties and 39 years for commercial properties. This non-cash deduction can substantially reduce taxable income. Understanding how to calculate and apply depreciation is crucial for maximizing tax savings.

1031 Exchanges and Capital Gains

A 1031 exchange, or like-kind exchange, allows property investors to defer capital gains tax by exchanging one investment property for another. This strategy can be particularly beneficial for investors looking to diversify their portfolios or upgrade their investments without immediate tax consequences. It’s essential to follow the IRS guidelines for 1031 exchanges to ensure eligibility for tax deferral.

Qualified Opportunity Zones

Qualified Opportunity Zones (QOZs) are an additional tax incentive program that offers tax benefits for investments in economically distressed areas. By investing in QOZs, property investors can defer and potentially reduce capital gains tax. Furthermore, if the investment is held for at least ten years, any future gains on the QOZ investment can be tax-free. Understanding the regulations and benefits of QOZs can provide significant tax advantages.

By employing these tax strategies, property investors can enhance their financial outcomes and achieve their investment goals more effectively.

Building and Scaling Your Property Portfolio

Diversification is a cornerstone of a successful property investment strategy, enabling investors to mitigate risks and enhance potential returns. As you build and scale your property portfolio, it’s essential to adopt a strategic approach that aligns with your investment goals.

From Single Property to Multiple Holdings

Starting with a single property, many investors aim to expand their holdings over time. This transition requires careful planning, including assessing financial readiness, market conditions, and the potential for future growth. Effective property portfolio management involves continuously monitoring and adjusting your strategy to optimize performance.

Diversification Strategies

Diversifying your property investments can be achieved through various strategies. Two key approaches include:

Geographic Diversification

Investing in properties across different geographic locations can help spread risk. By entering new markets, investors can capitalize on emerging trends and reduce dependence on a single area’s economic performance.

Property Type Diversification

Mixing different types of properties, such as residential, commercial, or industrial, within your portfolio can provide a buffer against market fluctuations. Each property type has its unique market dynamics, allowing for a balanced investment approach.

When to Hold and When to Sell

A critical decision for property investors is determining when to hold onto a property and when to sell. This decision should be based on your investment goals, market conditions, and the property’s performance. Regular portfolio reviews are essential to make informed decisions and ensure your property investments remain aligned with your objectives.

By implementing these strategies and maintaining a proactive approach to scaling investments, you can build a robust property portfolio that supports your long-term financial goals.

How PropertyInvestment.net Transforms Your Investment Journey

With PropertyInvestment.net, investors can now access a comprehensive platform that transforms their investment journey. This platform is designed to provide investors with the tools, resources, and community support needed to succeed in the competitive world of property investment.

Success Stories from the Platform

PropertyInvestment.net has already helped numerous investors achieve their goals. For instance, one investor was able to increase their portfolio by 30% within six months by utilizing the platform’s advanced market analysis tools. Such success stories underscore the platform’s effectiveness in guiding investors toward profitable decisions.

Advanced Tools and Resources

The platform offers a suite of advanced tools and resources, including real-time market data, property valuation models, and investment strategy guides. These resources enable investors to make informed decisions and stay ahead of market trends.

Community and Networking Opportunities

PropertyInvestment.net fosters a vibrant community of investors through various networking opportunities. Investors can engage with peers and experts through:

- Forums and discussion groups where they can share insights and ask questions.

- Expert webinars and events that provide education on the latest investment strategies.

Forums and Discussion Groups

These online spaces allow investors to connect with others who share similar interests and challenges. It’s a valuable resource for getting advice, sharing experiences, and staying updated on market news.

Expert Webinars and Events

PropertyInvestment.net regularly hosts webinars and events featuring industry experts. These sessions cover a range of topics, from market analysis to investment strategies, providing investors with actionable insights.

| Feature | Benefit | Outcome |

|---|---|---|

| Advanced Tools | Informed Decision Making | Better Investment Choices |

| Community Support | Networking Opportunities | Increased Portfolio Growth |

| Expert Insights | Staying Ahead of Market Trends | Maximized Returns |

Conclusion

As we conclude our exploration of successful property investing, it’s clear that PropertyInvestment.net is an invaluable resource for investors. By understanding the fundamentals of property investment, identifying profitable opportunities, and leveraging the right strategies, you can achieve your investment goals.

PropertyInvestment.net offers a comprehensive platform to navigate the complex world of property investing. With advanced tools, expert insights, and a community of like-minded investors, you’ll be well-equipped to make informed decisions and drive your investment success.

As you continue on your property investment journey, remember that knowledge, strategy, and the right resources are key to achieving long-term success. PropertyInvestment.net is committed to helping you every step of the way, providing the support and guidance you need to thrive in the world of property investment.

FAQ

What is PropertyInvestment.net and how can it help me with my property investments?

PropertyInvestment.net is a comprehensive guide to successful property investing, offering a range of tools, resources, and expert insights to help you navigate the world of real estate investing and achieve your investment goals.

What kind of tools and resources are available on PropertyInvestment.net?

PropertyInvestment.net offers a variety of tools and resources, including calculators, educational materials, and market research techniques, to help you make informed investment decisions and stay ahead of the curve in the property market.

How do I identify profitable investment opportunities using PropertyInvestment.net?

PropertyInvestment.net provides guidance on market research techniques, including demographic analysis and understanding economic indicators, to help you identify emerging property hotspots and profitable investment opportunities.

What are the different property investment strategies that I can use?

PropertyInvestment.net discusses various property investment strategies, including buy-and-hold, fix-and-flip, and rental properties, as well as investing in Real Estate Investment Trusts (REITs), to help you achieve your investment goals.

How can I finance my property investments?

PropertyInvestment.net explores traditional mortgage options, creative financing alternatives, and leveraging existing assets, such as home equity lines of credit, to help you fund your investment ventures.

What are the key metrics that every property investor should understand?

PropertyInvestment.net emphasizes the importance of understanding key metrics, including cash flow analysis, cap rate, and ROI calculations, to evaluate investment opportunities and make informed decisions.

How can I manage risk in my property investments?

PropertyInvestment.net provides guidance on risk management, including avoiding common pitfalls, creating contingency plans, and insurance considerations, to help you safeguard your investments.

What are the tax implications of property investing, and how can I minimize my tax liability?

PropertyInvestment.net discusses tax strategies, including maximizing deductions, understanding depreciation benefits, and 1031 exchanges, to help you optimize your investment returns and minimize your tax liability.

How can I build and scale my property portfolio?

PropertyInvestment.net offers guidance on building and scaling your property portfolio, including diversification strategies and deciding when to hold or sell properties, to help you achieve your long-term investment goals.

What kind of community and networking opportunities are available on PropertyInvestment.net?

PropertyInvestment.net provides access to forums, discussion groups, and expert webinars and events, allowing you to connect with other investors, share knowledge, and stay up-to-date on the latest industry trends.

The Power of Theatre Education: How Project Loop Helps You Grow On and Off the Stage

Theatre has always been more than bright lights and dramatic scripts. It’s a world filled with emotion, movement, creativity, and human connection. At Project Loop, we believe theatre training is not just for aspiring actors—it’s for anyone who wants to discover confidence, express themselves, and learn how to communicate in meaningful ways. Our school is built around the idea that every person has a story worth telling, and the stage is the perfect place to bring that story to life.

Unlocking Confidence Through Performance

Stepping onto a stage for the first time can feel overwhelming, but it’s also one of the most empowering experiences a person can have. Theatre pushes you to speak up, take risks, and trust your instincts. At Project Loop, we guide students through exercises that strengthen their voice, body awareness, and presence. Before long, even the shyest learners find themselves delivering lines with clarity, emotion, and boldness they didn’t know they had.

Creative Expression That Breaks Boundaries

In everyday life, people often hold back parts of themselves. In theatre, those boundaries disappear. Here, you can be loud, gentle, strange, funny, serious—whatever the role requires. Through acting, movement, and improvisation, students explore sides of themselves they never considered. This freedom to play is more than fun; it’s a vital part of self-discovery. Our classes encourage imagination, experimentation, and the courage to push beyond what feels familiar.

Learning the Art of Collaboration

Theatre is never a one-person show. Every performance relies on teamwork, listening, and respect. Students at Project Loop learn how to work as an ensemble, building trust and communication skills that carry over into school, work, and everyday life. Whether you’re performing in a scene or designing a set, collaboration becomes a natural part of the creative process. These moments teach patience, empathy, leadership, and the joy of achieving something together.

Developing Skills for Real Life

While our focus is artistic training, the benefits go far beyond the stage. Theatre builds resilience, discipline, and adaptability—qualities that support students in every area of life. Memorizing scripts improves focus and memory. Rehearsing teaches time management. Performing teaches you how to stay calm under pressure. Even the ability to read emotions and respond naturally becomes easier the more you practice. These are life skills that stay with you long after the final curtain call.

A Supportive Community for Every Performer

One of the most meaningful parts of Project Loop is the sense of belonging. Our studio is a safe place where students are encouraged to be themselves, celebrate their progress, and learn from mistakes. Teachers and peers cheer for each other, share honest feedback, and grow together through every rehearsal and performance. This supportive environment helps students feel seen, heard, and valued—on stage and off

Shaping the Future, One Story at a Time

Theatre has the power to change lives, challenge perspectives, and bring people together. At Project Loop, we’re committed to shaping the next generation of storytellers by giving them the space, skills, and confidence to shine. Whether you dream of acting professionally or simply want to explore your creative side, there’s a place for you here. When you walk into our studio, you’re not just learning theatre—you’re stepping into a world where imagination leads the way.